Super Brokers News

New Tool to Improve Credit Score

By: The Super BrokerScoreMaker gives advice to potential homebuyers on how to boost their credit score.

U.S. Market Sees Negative Equity and Mortgage Default Rise Hand in Hand

By: The Super BrokerTwenty-four per cent of all U.S. mortgagors owed more than their home was worth as of the end of the last quarter.

Is Home Ownership Actually a Hindrance in Retirement?

By: The Super BrokerAfter retirement, is it in your best interests to own your own home?

Canadian’s Debt Loads Reach All-Time High

By: The Super BrokerHistorically the cost of a home has equated three times the average Canadian worker’s income after tax.

Mortgage Arrears Tied to Job Market

By: The Super BrokerResearch illustrates that as employment possibilities decline, mortgage arrears rise.

Canadians Cognizant of Rising Debt Ratios

By: The Super BrokerContentions that Canadians risk their financial security and seek financing beyond their means are not true.

Use Renewal Time to Negotiate

By: The Super BrokerDon’t be submissive when your renewal date approaches. You can use this time to negotiate a better rate.

Safe Investing Points to Large-Cap Companies

By: The Super BrokerInvestors should be looking for companies with a strong potential to generate cash flow and with interest-swallowing debt loads well in check.

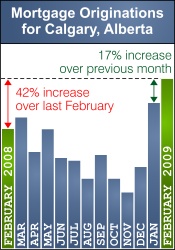

Record Number of Calgary Mortgage Originations

By: Daryl MaksymecCanEquity sees a record number of mortgages for Calgary in February of 2009.