Elias Kellendonk

Home Energy Audits: Government Rebates to Fix up your Home

It’s a win-win situation: renovate your home, improve energy efficiency, lower your monthly bills and get up to $5,000 back in an ecoENERGY grant to pay for a portion of it. That’s exactly what the Government of Canada is offering through the ecoENERGY Home Retrofit Program, which was extended June, 6 2011. In order to …

Wall Street: From New Amsterdam to this Quarter’s Close

For more than 400 years Manhattan has been the site of big trades, big gains and big losses. The island was originally purchased in 1626 from the Lenape Native Americans for a sum of 60 Dutch guilders, the equivalent of roughly $24, by the Walloon director-general Peter Minuit. At this time the city was hailed …

Investing for Young People Part 3: Differentiating Mutual Funds

Perhaps jumping into the stock market has turned out to be more of a chore than you and your child anticipated. If savings bonds and GICs are not offering the rates of return you and your child would like to see their savings yielding, mutual funds are a promising alternative. At current Canadians have well …

Investing for Young People Part 2: The Difference Between Stocks, Bonds and Mutual Funds

How to Pick your Stocks Now that your child is proficiently handling their chequing account, making debits and deposits responsibly, and has assessed their risk tolerance, it is time to locate an investment vehicle that will see their savings dollars grow. While an allowance and monetary birthday/holiday gifts might line the accounts, authoress Katherine R. …

Investment Strategies for Young People

Helping Your Kids Get into Investing Early In this Internet-dominated, economy-fearing age it may be possible that your kids will out-know you in terms of stocks and trading before they finish grade school. American author Katherine R. Bateman suggests in her book, The Young Investor: Projects and Activities for Making Your Money Grow that no …

What is TFSA: Why Canadians should be Investing Tax-Free

How will the Canada Tax Free Savings Account Guard your Retirement Funds? Registered or unregistered – that seems to be the question as Canadians plan and gear their savings and investment accounts toward retirement. Most experts advise that your investments gain a return in excess of two per cent in order to beat annual inflation. …

Bank of Canada Holds Prime Rate in Face of Unpredictable Global Climate

Bank Steadies itself as Possible Domino Effect Threatens European Economies What a large number of analysts have been predicting for months has proven true; the Bank of Canada has opted to keep its benchmark, overnight interest rate at 1 per cent. The rate announcement came with a message: at present, combating inflation needs take a …

Stampede Buzz of Activity Could Mark Economic Recovery

Local Businesses see Up-Surge of Corporate Spending Is it the enchantment cast by the recent visit of the Duke and Duchess, which sadly ends today, or an indication that the City of Calgary is enjoying better economic times? According to yesterday’s Calgary Herald, the answer lies in the latter. The Herald highlights the fact that …

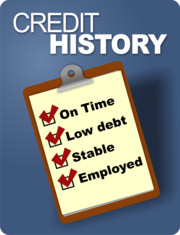

Improve Bad Credit in Six Easy Steps

Credit score is one of the major players in determining the amount of financing and interest rate you are eligible to receive. Credit history proves to lenders how reliable you are when granted funds. Leading up to your mortgage application, there are six, quite simple steps you can take to help improve your credit rating. …

Drunk Driving Highest in Interior BC Towns, Not Urban Areas

According to ICBC investigation records, as accessed by Global News in an exclusive investigation, the postal code areas showing the highest rates of alcohol-related suspensions are within interior towns, not heavier populated urban areas. The top 10 highest volumes of alcohol-related suspensions per postal code – ranging from 12-hour license suspensions to impaired driving causing …